s corp tax calculator nyc

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. With Social Security at 124 and Medicare at 29 Self-Employment is a major cost of 153 right off the top before theres any income taxes paid.

I Will Do Bookkeeping Using Quickbooks Online Xero Excel Quickbooks Online Bookkeeping Services Quickbooks

The NYC S Corp Tax provides a wide array of tax benefits for prospective owners of small businesses.

. Publicly traded partnerships that were. Use this calculator to get started and uncover the tax savings youll. We are not the biggest.

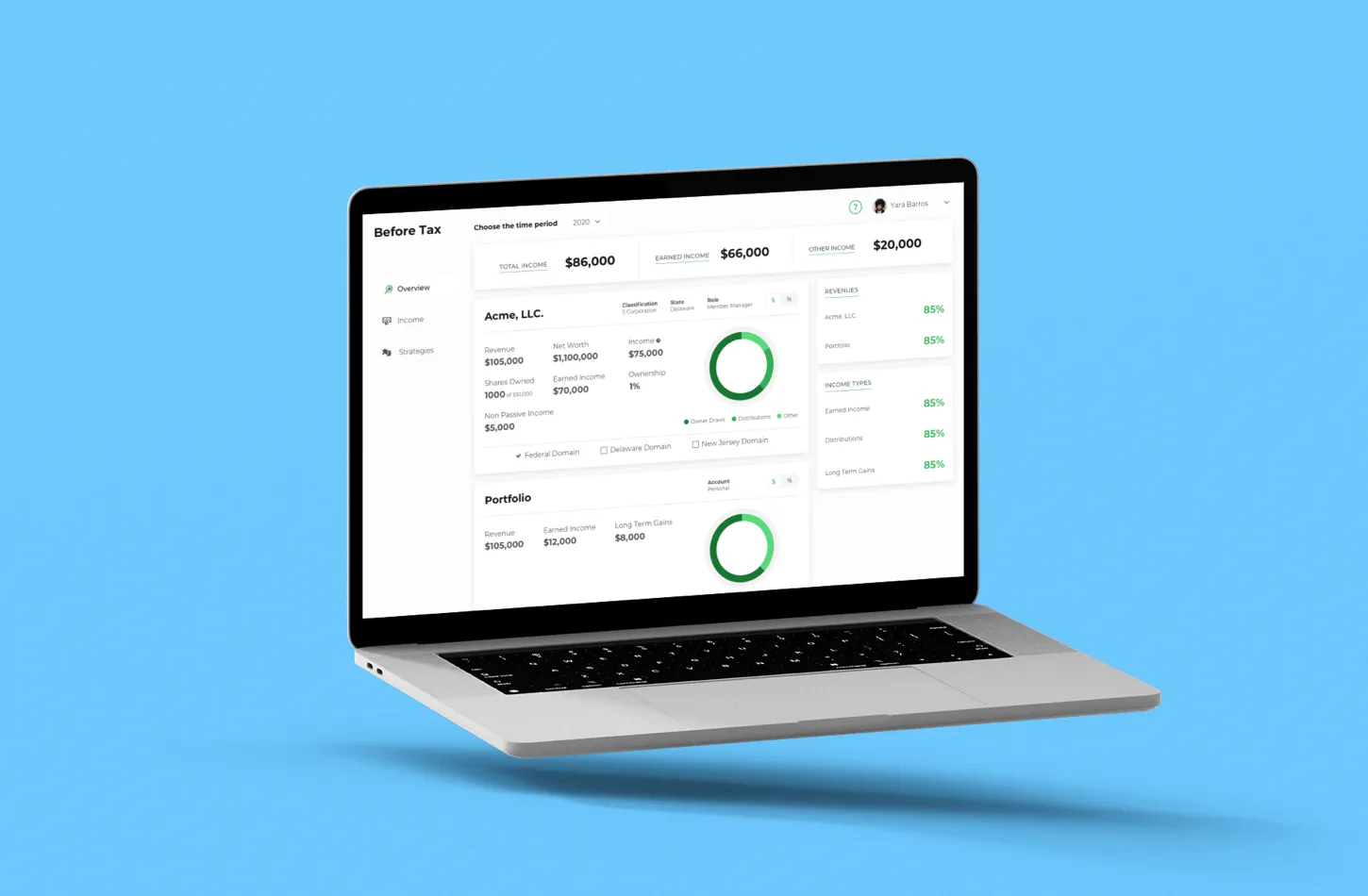

Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps. Ad eFiling Is The Quickest Way To Submit Your Return All From The Comfort Of Your Home. The S Corp Tax Calculator.

After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship. After the formation of the corporation in New York you need to apply for S corporation with the state and federal tax departments. Ad We Simplify The Process And Keep It Industry-Specific So You Can File Taxes w Confidence.

However if you elect to. Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed. New Yorks estate tax is based on a graduated rate.

In order to gain New York tax-exempt status a corporation must qualify as a 501c and obtain a Nonprofit Tax-Exempt ID Number from the IRS. This calculator helps you estimate your potential savings. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes.

Being Taxed as an S-Corp Versus LLC. New York Estate Tax. 15 rows Form IT-2658 is used by partnerships and S corporations to report and pay estimated.

New York may also require nonprofits to file. Here are few considerations when forming an S. For example if you have a.

S-corporations are exempt from the Business Corporate Tax but they are still subject to the General Corporation Tax or Banking Corporation Tax. The instructions to Forms NYC-3L and NYC-4S explain in detail which types of S corporations. Self Employed Tax Filing With Step-by-step Guidance To Help Maximize Your Deductions.

Shareholders pay New York tax on their pro rata share of the S corporation pass-through items of income gain loss and deduction that are includable in their federal adjusted. The S Corporation tax calculator below lets you choose how much to withdraw from your business each year and how much of it you will take as salary with the. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York.

AS a sole proprietor Self Employment Taxes paid as a Sole. But as an S corporation you would only owe self-employment tax on the 60000 in. As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770.

New York City is an economic hub and part of the engine that makes the global. Ad We Simplify The Process And Keep It Industry-Specific So You Can File Taxes w Confidence. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax.

Lets start significantly lowering your tax bill now. This application calculates the. This could potentially increase the S-corp tax bill significantly and.

Ad eFiling Is The Quickest Way To Submit Your Return All From The Comfort Of Your Home. Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed. Self Employed Tax Filing With Step-by-step Guidance To Help Maximize Your Deductions.

Start Using MyCorporations S Corporation Tax Savings Calculator. From the authors of Limited Liability Companies for Dummies. Forming an S-corporation can help save taxes.

How Much To Set Aside For Small Business Taxes Bench Accounting

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

I Will Do Bookkeeping Using Quickbooks Online Xero Excel Quickbooks Online Bookkeeping Services Quickbooks

How To File Previous Year Taxes Online Priortax Online Taxes Previous Year Tax

Interview With Graphic Designer Rafael Esquer Of Alfalfa Studio I Love Ny Graphic Design Logo

The Donotpay App Is The Home Of The World S First Robot Lawyer Fight Corporations Beat Bureaucracy And Sue Anyone At The Press Of A First World Fight Lawyer

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

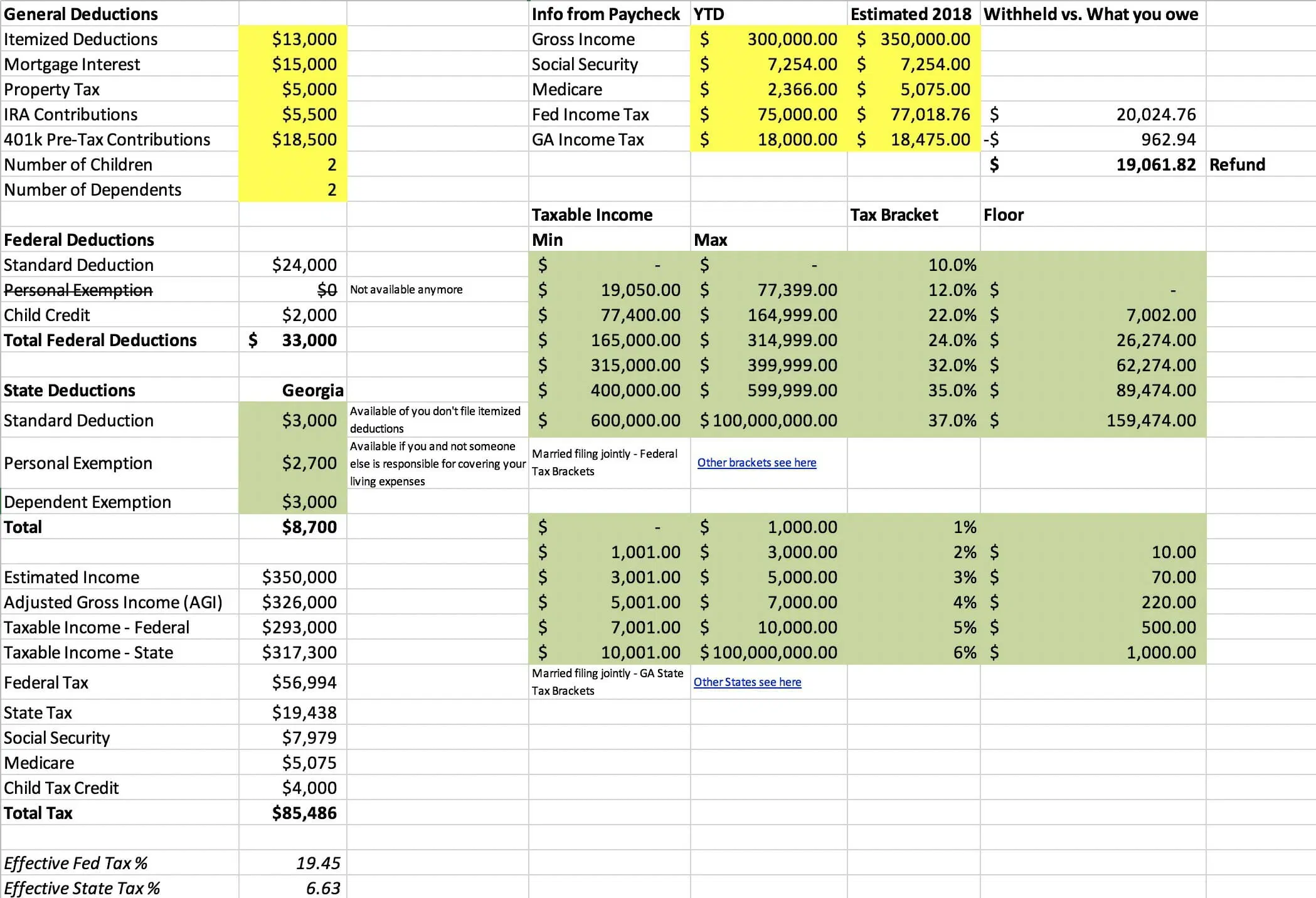

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

State Corporate Income Tax Rates And Brackets Tax Foundation

S Corp Vs Llc Calculator Truic

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

New York City Accountant Cpa Firm Manhattan Cpa Http Www Njcpany Com Certified Public Accountant Accounting Cpa

You Can Rely Upon Our Professional Expertise Small Business Funding Stock Market Business Funding

How Exactly Does Rank Calculation Work In The Network Marketing Business Make Money On Amazon Network Marketing Business Earn Money Online

S Corp Tax Calculator Llc Vs C Corp Vs S Corp